NEWSFLASH: Since the article below was published the Fed raised interest rates. As noted in USAToday on 3.16.22:

Moving to curtail a historic surge in consumer prices, the Fed raised its key short-term interest rate Wednesday – by a quarter-percentage point – for the first time in more than three years and forecast six more hikes this year. That’s up from the three total quarter-point increases Fed officials predicted in December and more than the six moves many top economists predicted this week. The Fed forecast another four hikes in 2023.

By: Devon Porpora

Senior Managing Director

Wealth Manager

First Republic Investment Management

This week it is widely expected that the Federal Reserve will raise interest rates for the first time since they dropped them to the floor in 2020 at the outbreak of the pandemic. This is the beginning of a rate hiking cycle with seven expected this year and five more forecasted to follow in 2023. This will take the Fed Funds Interest rate from .25% today to 3%, or what is considered “neutral”. This means all borrowing will get meaningfully more expensive over the next two years. People will take on less debt, slowing the creation of dollars (and the economy) and combating inflation.

What does this mean for the stock market? Rising costs are not good for companies, but stocks are positively correlated with rising rates. This is because rates are typically increased into an expanding economy which pushes profits higher. At the end of the day earnings are the most important variable for stocks and if they are expected to increase, so do indexes.

Today is a bit different as it is unknown how much the war, sanctions and high energy prices will dent the economy. The Federal Reserve will slow the rate hikes if necessary, but for now they are moving full speed ahead. We will know more this week. See below for the note from our research team.

Week in Review: March 11, 2022

Red-Hot Inflation Is Very Uncomfortable

U.S. equities ended the week lower, unable to build on Wednesday’s rally (largest since June 2020). Russia and Ukraine remain in a stalemate as talks continue. Ukraine’s neutrality comments were cause for some optimism. Consumer prices came in red-hot, driven by fuel and food increases. Geopolitical and inflation headwinds keep us cautious in the near term, and economic growth continues to be positive, but at a slower pace.

February’s Consumer Price Index (CPI) rose 0.8% month over month and 7.9% year over year, a 40-year high (see Figure 1). The month-over-month rise was broad-based, driven primarily by a 6.6% increase in gas prices and 1% increase in food prices. We expect these components to drive inflation higher in the near term and for it to stay high, exacerbated by the Russia-Ukraine conflict. However, in the long term, if the U.S. announces an energy security policy that results in self-sufficient energy production, this would give the U.S. more control over energy stability and be bullish for the economy and equities.

Beyond energy and food components, consumer prices rose significantly across all sub-components. Shelter prices increased by 0.5% and vehicle prices increased by 0.3% month over month. We expect these components of the CPI to rise higher in the near term and inflation to end the year well above the Federal Reserve’s target of 2%. We expect headline inflation to end the year around 6%. We anticipate sticky inflation to hurt sentiment and dampen real growth. The University of Michigan sentiment index dropped in March indicating the impact that inflation is having on the consumer. On the corporate side, margins have peaked, reflecting that inflation is starting to eat into earnings. Going forward, we believe higher inflation will cause margin compression.

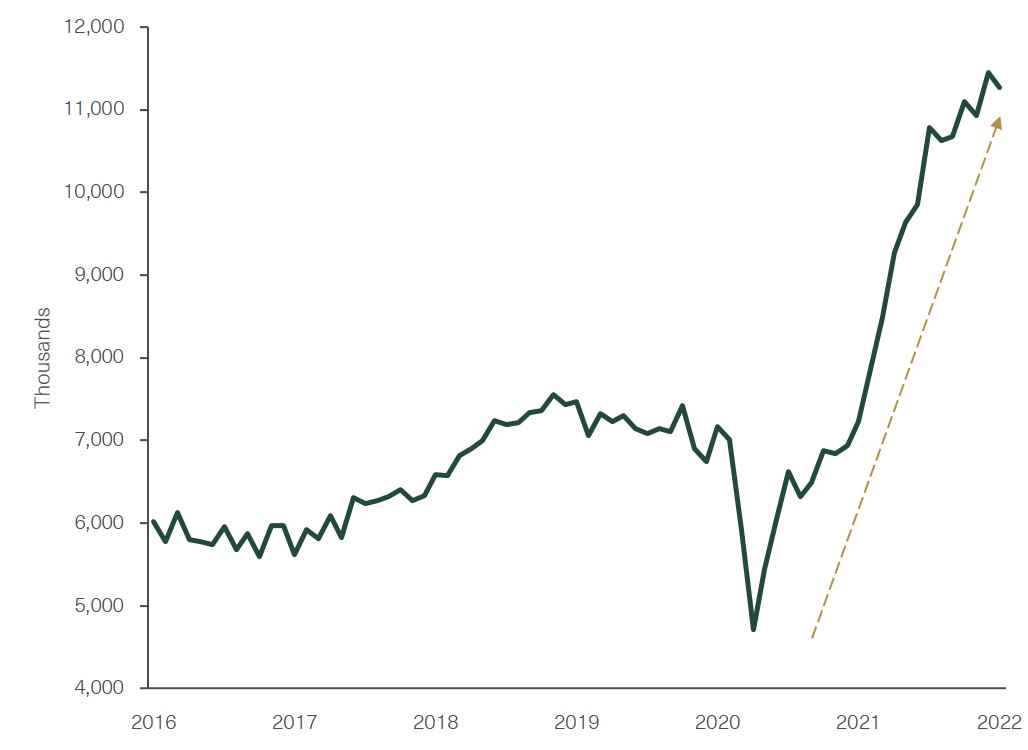

Soaring consumer prices are hurting consumer savings and slowing real economic growth, however, the labor market remains resilient. Greater-than-expected (11,263,000) job openings in January are a positive sign that jobless claims will decline in upcoming months (see Figure 2). Difficulties in hiring forces employers to pay more to attract talented employees. Greater wages for employees are a positive for the consumer balance sheet.

The strong labor market recovery and high inflation add support for the Fed to hike interest rates next Wednesday. Even though the Fed is done buying assets, the European Central Bank (ECB) will continue its regular purchasing program until at least the fall, marking the first-time central banks diverged in over two years.

From an equity standpoint, we expect pockets of episodic volatility as geopolitical and inflationary risks rise and the Fed begins raising rates. Going forward, we expect more muted returns and a wider range of outcomes. Within equities, we note tactical, intermediate and thematic opportunities for investors. The current macro backdrop suggests a “stay at home” approach, wherein U.S. equities are favored for an attractive blend of growth, quality and shareholder yield. Energy and commodity-related exposures should prosper in the near term as prices remain high and likely to continue being elevated in coming months. On a secular basis, profitable technology companies remain favored as the structural shift toward digitization, artificial intelligence, Big Data and automation will persist as a tailwind of growth for those exposed. These thematic concepts are not limited to a single sector — they transcend industries. Leaders in each space are well positioned for sustained success, in our view.

Outside of U.S. equities, we remain underweight in Emerging Markets due to weakness in China. We remain underweight in fixed income and short in duration, particularly as the Fed is poised to raise rates.

THE WEEK AHEAD

- February’s PPI is expected to decline to 0.80% month over month, released on Tuesday.

- At the FOMC meeting, we expect the Fed to begin hiking interest rates by 25 bps on Wednesday.

- February’s retail sales are expected to decline to 0.40% month over month, released on Wednesday.

Figure 1: U.S. CPI (YoY)

Source: Bureau of Labor Statistics.

Figure 2: U.S. job openings by industry